Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

the Securities Exchange Act of 1934 (Amendment No. )

| | |

Filed by the Registrantý [X] | |

Filed by a Party other than the Registranto [ ] | | |

| | |

| Check the appropriate box: | | |

o[ ] |

|

Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 |

o[ ] |

|

Confidential, forFor Use of the

Commission Only (as permitted

by Rule 14a-6(e)(2)) | | |

ý[X] |

|

Definitive Proxy Statement | |

o[ ] |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

| | | | |

| AGILENT TECHNOLOGIES, INC. | |

| (Name of Registrant as Specified In Its Charter) | |

| | |

| | |

| (Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant) | |

Payment of Filing Fee (Check the appropriate box): |

ý[X] |

|

No fee required. |

o[ ] |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1)(4) and 0-11. |

| | | (1)1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | |

| | 2) | | Aggregate number of securities to which transaction applies:

|

| | | | |

(3) | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | | |

(4) | | 4) | | Proposed maximum aggregate value of transaction:

|

| | | | |

(5) | | 5) | | Total fee paid:

|

o |

|

| | |

| [ ] | | Fee paid previously with preliminary materials.materials: |

o[ ] |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Formform or Scheduleschedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2)1) | | Amount previously paid: |

| | | | |

| | 2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | |

| | 3) | | Filing Party:

|

| | | (4) | | |

| | 4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Table of Contents

|

|

Agilent Technologies, Inc.

5301 Stevens Creek Blvd.

Santa Clara, California 95051

William P. Sullivan

President and Chief Executive Officer |

January 2010February 2013

To our Stockholders:

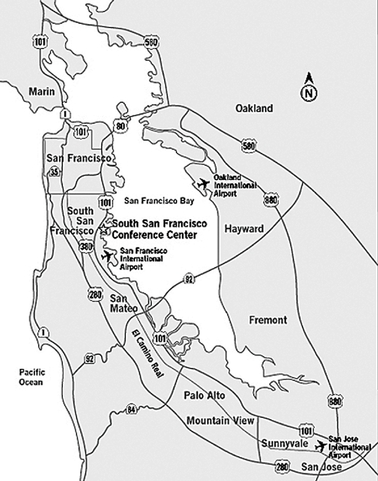

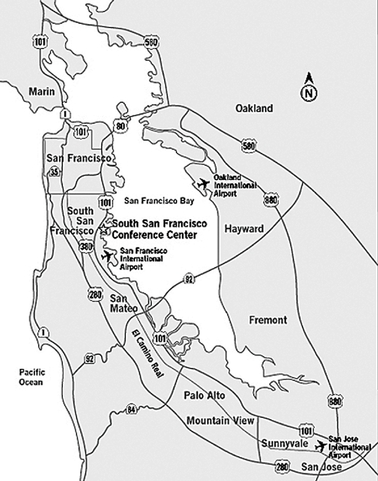

I am pleased to invite you to attend the annual meeting of stockholders of Agilent Technologies, Inc. ("Agilent"(“Agilent”) to be held on Tuesday,Wednesday, March 2, 201020, 2013 at 10:8:00 a.m., Pacific StandardPacificStandard Time, at the South San Francisco Conference CenterAgilent’s headquarters located at 255 South Airport Boulevard, South San Francisco,5301 Stevens Creek Blvd., Building No. 5, Santa Clara, California (U.S.A.). Details regarding admission to the annual meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

If you are unable to attend the annual meeting in person, you may participatelisten through the Internet or by telephone. To participate inlisten to the live webcast, log on at www.investor.agilent.com and select the link for the webcast. To listen by telephone, please call (800) 510 0219510-9834 (international callers should dial (617) 614 3451)614-3669). The meeting pass code is 35104330.78119177. The webcast will begin at 10:8:00 a.m. and will remain on Agilent'sAgilent’s website for one year. You cannot record your vote or ask questions on this website or at this phone number.

We have elected to take advantage of Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. We believe that the rules will allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the annual meeting.

Your vote is important. Whether or not you plan to attend the annual meeting, I hope that you will vote as soon as possible. Please review the instructions on each of your voting options described in the Proxy Statement and the Notice of Internet Availability of Proxy Materials you received in the mail.

Thank you for your ongoing support of, and continued interest in, Agilent.

Sincerely,

Admission to the annual meeting will be limited to stockholders. Please note that an admission ticket and picture identification will be requiredYou are entitled to enterattend the annual meeting only if you are a stockholder of record as of the close of business on January 22, 2013, the record date, or hold a valid proxy for the meeting. Each stockholder willIn order to be entitled to bring a guestadmitted to the annual meeting. For stockholdersmeeting, you must present proof of record, an admission ticket is printedownership of Agilent stock on the back cover of these proxy materials. Therecord date. This can be a brokerage statement or letter from a bank or broker indicating ownership on January 22, 2013, the Notice of Internet Availability of Proxy Materials, will also serve as an admission ticket. An individual arriving without an admission ticket will not be admitted unless it can be verified thata proxy card, or legal proxy or voting instruction card provided by your broker, bank or nominee. Any holder of a proxy from a stockholder must present the individual was an Agilent stockholder asproxy card, properly executed, and a copy of the record date.proof of ownership. Stockholders and proxyholders may also be asked to present a form of photo identification such as a driver’s license or passport. Backpacks, cameras, cell phones with cameras, recording equipment and other electronic recording devices will not be permitted at the annual meeting. Agilent reserves the right to inspect any persons or itemsproposals prior to their admission to the annual meeting. Failure to follow the meeting rules or permit inspection will be grounds for exclusion from the annual meeting.

Table of Contents

2010 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

| | | | | |

| | Page | |

|---|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | 1 | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| | | 2 | |

| Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

| | | 2 | |

| Why am I receiving these materials?

| | | 2 | |

| What is included in these materials?

| | | 2 | |

| What information is contained in these materials?

| | | 2 | |

| What proposals will be voted on at the annual meeting?

| | | 2 | |

| What is the Agilent Board's voting recommendation?

| | | 2 | |

| What shares owned by me can be voted?

| | | 3 | |

| What is the difference between holding shares as a stockholder of record and as a beneficial owner?

| | | 3 | |

| How can I vote my shares in person at the annual meeting?

| | | 3 | |

| How can I vote my shares without attending the annual meeting?

| | | 4 | |

| Can I revoke my proxy or change my vote?

| | | 4 | |

| How are votes counted?

| | | 4 | |

| What is the voting requirement to approve each of the proposals?

| | | 5 | |

| What does it mean if I receive more than one Notice, proxy or voting instruction card?

| | | 5 | |

| How can I obtain an admission ticket for the annual meeting?

| | | 5 | |

| Where can I find the voting results of the annual meeting?

| | | 5 | |

BOARD STRUCTURE AND COMPENSATION

| | | 6 | |

DIRECTOR COMPENSATION AND STOCK OWNERSHIP GUIDELINES

| | | 12 | |

PROPOSALS TO BE VOTED ON

| | | 15 | |

| PROPOSAL NO. 1—Election of Directors

| | | 15 | |

| PROPOSAL NO. 2—Ratification of Independent Registered Public Accounting Firm

| | | 19 | |

| PROPOSAL NO. 3—Approval of the Agilent Technologies, Inc. Performance-Based Compensation Plan for Covered Employees

| | | 20 | |

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

| | | 25 | |

| Beneficial Ownership Table

| | | 25 | |

| Section 16(a) Beneficial Ownership Reporting Compliance

| | | 28 | |

COMPENSATION DISCUSSION AND ANALYSIS

| | | 29 | |

COMPENSATION COMMITTEE REPORT

| | | 44 | |

EXECUTIVE COMPENSATION

| | | 45 | |

| Summary Compensation Table

| | | 45 | |

| Grants of Plan Based Awards in Last Fiscal Year

| | | 48 | |

| Outstanding Equity Awards at Fiscal Year-End

| | | 49 | |

| Option Exercises and Stock Vested at Fiscal Year-End

| | | 51 | |

| Pension Benefits

| | | 51 | |

| Non-Qualified Deferred Compensation in Last Fiscal Year

| | | 54 | |

| Termination and Change of Control Arrangements

| | | 55 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

| | | 59 | |

RELATED PERSON TRANSACTIONS POLICY AND PROCEDURES

| | | 59 | |

AUDIT AND FINANCE COMMITTEE REPORT

| | | 60 | |

ADDITIONAL QUESTIONS AND INFORMATION REGARDING THE ANNUAL MEETING AND STOCKHOLDER PROPOSALS

| | | 63 | |

| What happens if additional proposals are presented at the annual meeting?

| | | 63 | |

| What class of shares is entitled to be voted?

| | | 63 | |

| What is the quorum requirement for the annual meeting?

| | | 63 | |

| Who will count the vote?

| | | 63 | |

| Is my vote confidential?

| | | 63 | |

| Who will bear the cost of soliciting votes for the annual meeting?

| | | 63 | |

| May I propose actions for consideration at next year's annual meeting of stockholders or nominate individuals to serve as directors?

| | | 64 | |

| How do I obtain a separate set of voting materials if I share an address with other stockholders?

| | | 64 | |

| If I share an address with other stockholders of Agilent, how can we get only one set of voting materials for future meetings?

| | | 65 | |

Table of Contents

AGILENT TECHNOLOGIES, INC.

5301 Stevens Creek Blvd.

Santa Clara, California 95051

(408) 553-2424

Notice of Annual Meeting of Stockholders

| | | | |

TIME | | 10:8:00 a.m., Pacific Standard Time, on Tuesday,Wednesday, March 2, 201020, 2013 |

|

| PLACE | | Agilent’s Headquarters

5301 Stevens Creek Boulevard, Building No. 5

Santa Clara, California (U.S.A.) |

| | | South San Francisco Conference Center

255 South Airport Boulevard

South San Francisco, California (U.S.A.)

|

ITEMS OF BUSINESS | | (1) To elect twothree directors to a 3-year term. At the annual meeting, the Board of Directors intends to present the following nominees for election as directors: |

| | |

•

| | - Paul N. Clark

- James G. Cullen

- Tadataka Yamada, M.D.

|

| | |

| | •

| | James G. Cullen |

| | (2) To ratify the Audit and Finance Committee'sCommittee’s appointment of PricewaterhouseCoopers LLP as Agilent'sAgilent’s independent registered public accounting firm. |

| | |

| | (3) To approve, on a non-binding advisory basis, the Agilent Technologies, Inc. Performance-Based Compensation Plan for Covered Employees.compensation of Agilent’s named executive officers. |

| | |

| | (4) To consider a stockholder proposal, if properly presented at the annual meeting, regarding board declassification. |

| | (4)

|

| | (5) To consider such other business as may properly come before the annual meeting. |

|

| RECORD DATE | | You are entitled to vote at the annual meeting and at any adjournments or postponements thereof if you were a stockholder at the close of business on Wednesday,Tuesday, January 6, 2010. 22, 2013. |

| | |

| ANNUAL MEETING ADMISSION | | Two cut-out admission tickets are printedTo be admitted to the annual meeting, you must present proof of ownership of Agilent stock as of the record date. This can be a brokerage statement or letter from a bank or broker indicating ownership on January 22, 2013, the back coverNotice of theseInternet Availability of Proxy Materials, a proxy materials. Please contact Agilent's Investor Relations Department at our headquarterscard, or legal proxy or voting or voting instruction card provided by your broker, bank or nominee. You may also be asked to request additional tickets.

|

| | present a form of photo identification such as a driver’s license or passport. The annual meeting will begin promptly at 10:8:00 a.m. Limited seating is available on a first come, first served basis. |

VOTING

| | |

VOTING | | For instructions on voting, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail or, if you received a hard copy of the Proxy Statement, on your enclosed proxy card. |

| | |

|

|

By Order of the Board, |

|

| MARIEOHHUBER |

|

|

|

|

|

MARIE OH HUBER

Senior Vice President, General Counsel and |

Secretary

|

This Proxy Statement and the accompanying proxy card are being sent or made available

on or about January 19, 2010.February 6, 2013.

| SUMMARY INFORMATION |

PROXY SUMMARY

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING

Q: Why did I receive The following is a one-page noticesummary which highlights information contained elsewhere in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

A:In accordance with rules and regulations adopted by the Securities and Exchange Commission (the "SEC"), instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials, including this Proxy Statement. This summary does not contain all of the information you should consider, and you are urged to read the entire Proxy Statement carefully before voting.Voting Matters and Vote Recommendations

There are four items of business which Agilent currently expects to be considered at the 2013 Annual Meeting. The following table lists those items of business and the Agilent Technologies, Inc. ("Agilent" or the "Company") 2009 Annual Report to Stockholders, by providing access to such documents on the Internet. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, commencing on or about January 19, 2010, a Notice of Internet Availability of Proxy Materials (the "Notice") was sent to most of our stockholders which will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

Q: Why am I receiving these materials?

A:Agilent's Board of Directors (the "Board") is providing these proxy materials to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with Agilent's annual meeting of stockholders, which will take place on March 2, 2010. Stockholders are invited to attend the annual meeting and are requested toBoard’s vote on the proposals described in this Proxy Statement.

Q: What is included in these materials?recommendation.

A:These materials include:

•our Proxy Statement for Agilent's annual meeting; and

•our 2009 Annual Report to Stockholders, which includes our audited consolidated financial statements.| PROPOSAL | BOARD VOTE RECOMMENDATION |

| Management Proposals | |

| Election of Directors | For each director nominee |

| Ratification of the Independent Registered Public Accounting Firm | For |

| Advisory Vote to Approve Named Executive Officer Compensation | For |

| Stockholder Proposal | |

| Stockholder Proposal Regarding Board Declassification | Against |

If you requested printed versions of these materials by mail, these materials also include the proxy card for the annual meeting.Director Nominees

Q: What information is contained in these materials?

A:The information included in this Proxy Statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of directors and our most highly paid officers and certain other required information.

Q: What proposals will be voted on at the annual meeting?

A:There are three proposals scheduled to be voted on at the annual meeting:

•the election of two directors for a 3-year term;

•the ratification of the Audit and Finance Committee's appointment of PricewaterhouseCoopers LLP as Agilent's independent registered public accounting firm; and

•the approval of Agilent's Performance-Based Compensation Plan for Covered Employees.

Q: What is the Agilent Board's voting recommendation?

A:Agilent's Board recommends that you vote your shares"FOR" each of the

Table of Contents

nominees to the Board, "FOR" the ratification of the Audit and Finance Committee's appointment of PricewaterhouseCoopers LLP as Agilent's independent registered public accounting firm, and "FOR" the approval of Agilent's Performance-Based Compensation Plan for Covered Employees.

Q: What shares owned by me can be voted?

A:All shares owned by you as of the close of business on January 6, 2010 (the "Record Date") may be voted. You may cast one vote per share of common stock that you held on the Record Date. These shares include shares that are: (1) held directly in your name as the stockholder of record, including shares purchased through the Agilent Technologies, Inc. 1999 Stock Plan and 2009 Stock Plan and the Agilent Technologies, Inc. Employee Stock Purchase Plan, and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee or held for your account by the Agilent Technologies, Inc. 401(k) Plan or Deferred Compensation Plans.

Q: What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A:Most stockholders of Agilent hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with Agilent's transfer agent, Computershare Investor Services, you are considered, with respect to those shares, the stockholder of record, and the Notice, or if requested, these proxy materials are being sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the persons named as proxy holders, William P. Sullivan, Agilent's President and Chief Executive Officer, and Marie Oh Huber, Agilent's Senior Vice President, General Counsel and Secretary, or to vote in person at the annual meeting. If you requested printed copies of the proxy materials, Agilent has enclosed a proxy card for you to use. You may also vote on the Internet or by telephone, as described below under the heading "How can I vote my shares without attending the annual meeting?"

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in "street name", and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the annual meeting. Your broker or nominee has enclosed a voting instruction card for you to use in directing your broker or nominee as to how to vote your shares. You may also vote by Internet or by telephone, as described below under "How can I vote my shares without attending the annual meeting?"

Q: How can I vote my shares in person at the annual meeting?

A:Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to vote your shares in person at the annual meeting, please bring your admission ticket or the enclosed proxy card and proof of identification. Even if you plan to attend the annual meeting, Agilent recommends that you vote your shares in advance as described below so

Table of Contents

that your vote will be counted if you later decide not to attend the annual meeting.

Shares held in "street name" may be voted in person by you only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

Q: How can I vote my shares without attending the annual meeting?

A:Whether you hold your shares directly as the stockholder of record or beneficially in "street name", you may direct your vote without attending the annual meeting by proxy. You can vote by proxy over the Internet or by telephone. Please follow the instructions provided in the Notice, or, if you request printed copies of proxy materials, on the proxy card or voting instruction card you receive.

Q: Can I revoke my proxy or change my vote?

A:You may revoke your proxy or change your voting instructions at any time prior to the vote at the annual meeting. You may enter a new vote by using the Internet or the telephone or by mailing a new proxy card or new voting instruction card bearing a later date (which will automatically revoke your earlier voting instructions) or by attending the annual meeting and voting in person. Your attendance at the annual meeting in person will not cause your previously granted proxy to be revoked unless you specifically so request.

Q: How are votes counted?

A:In the election of directors, your vote may be cast "FOR" or "AGAINST" one or more of the nominees, or you may "ABSTAIN" from voting with respect to one or more of the nominees. Shares voting "ABSTAIN" have no effect on the election of directors.

For the other proposals, your vote may be cast "FOR" or, "AGAINST" or you may "ABSTAIN." If you "ABSTAIN", it has the same effect as a vote "AGAINST." If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted in accordance with the recommendations of the Board. Any undirected shares that you hold in Agilent's 401(k) Plan will be voted in proportion to the way the other 401(k) Plan stockholders vote their 401(k) Plan shares.

Abstentions

If you specify that you wish to "abstain" from voting on an item, your shares will not be voted on that particular item. Abstentions are counted toward establishing a quorum and included in the shares entitled to vote on the ratification of the Audit and Finance Committee's appointment of PricewaterhouseCoopers LLP as Agilent's independent registered public accounting firm, and the approval of Agilent's Performance-Based Compensation Plan for Covered Employees and therefore have the effect of a vote against the proposals.

Broker Non-Votes

Under the New York Stock Exchange ("NYSE") rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote these shares on certain "routine" matters, including the ratification of the Audit and Finance Committee's appointment of PricewaterhouseCoopers LLP as Agilent's independent registered public accounting firm. However, on non-routine matters such as the election of directors and the approval of Agilent's Performance-Based Compensation Plan, your broker must receive voting instructions from you, as it does not have discretionary voting power for these particular items. So long as the broker has discretion to vote on at least one proposal, these "broker non-votes" are counted toward establishing a quorum. When voted on "routine"

Table of Contents

matters, broker non-votes are counted toward determining the outcome of that "routine" matter.

Q: What is the voting requirement to approve each of the proposals?

A:In the election for directors, each nominee for director shall be elected if he receives the majority of the votes cast with respect to that director. A "majority of the votes cast" shall mean that the number of shares voted "FOR" a director must exceed 50% of the votes cast with respect to that director. The "votes cast" shall include votes to withhold authority and exclude votes to "ABSTAIN" with respect to that director's election. The affirmative vote of a majority of those shares present and entitled to vote is required to approve (i) the ratification of the Audit and Finance Committee's appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, and (ii) Agilent's Performance-Based Compensation Plan for Covered Employees. If you are a beneficial owner of Agilent shares and do not provide the stockholder of record with voting instructions, your beneficially owned shares may constitute broker non-votes, as described in "What is the quorum requirement for the annual meeting?" in the section entitled "Additional Questions and Information Regarding the Annual Meeting and Stockholder Proposals" located at the end of this Proxy Statement. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote.

Q: What does it mean if I receive more than one Notice, proxy or voting instruction card?

A:It means your shares are registered differently or are in more than one account. For all Notices you receive, please enter your vote by Internet for each control number you have been assigned. If you received paper copies of proxy materials, please provide voting instructions for all proxy and voting instruction cards you receive.

Q: How can I obtain an admission ticket for the annual meeting?

A:An admission ticket is printed on the back cover of these proxy materials or you may use the Notice for admission to the Annual Meeting.

Q: Where can I find the voting results of the annual meeting?

A:Agilent will announce preliminary voting results at the annual meeting and publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting.

Table of Contents

BOARD STRUCTURE AND COMPENSATION

TheAgilent’s Board is divided into three classes serving staggered three-year terms. The Board has nine directors andfollowing table provides summary information about each of the following four committees: (1)three director nominees who are being voted on at the Annual Meeting.

| | | | | COMMITTEE | OTHER |

| | DIRECTOR | | INDE- | MEMBERSHIPS | PUBLIC |

| NAME | AGE | SINCE | OCCUPATION | PENDENT | AC | CC | NCG | EC | BOARDS |

| Paul N. Clark | 65 | 2006 | Operating Partner of | Yes | M | | M | | 0 |

| | | Genstar Capital, LLC | | | | | | |

| James G. Cullen | 70 | 2000 | Former President | Yes | | | C | C | 3 |

| | | and Chief Operating | | | | | | |

| | | Officer of Bell | | | | | | |

| | | Atlantic Corporation | | | | | | |

| Tadataka Yamada, M.D. | 67 | 2011 | Chief Medical | Yes | | M | M | | 1 |

| | | and Scientific | | | | | | |

| | | Officer of Takeda | | | | | | |

| | | Pharmaceuticals | | | | | | |

| | | International, Inc. | | | | | | |

Key: AC: Audit and Finance, (2)Committee; CC: Compensation (3)Committee; NCG: Nominating/Corporate Governance and (4) Executive. The number of Directors is currently fixed at nine. On November 18, 2009, Robert L. Joss gave written notice to Agilent that, effective March 2, 2010, immediately before the annual meeting of stockholders of the Company, he will resign as a member of the Board of Directors of Agilent. Pursuant to resolutions passed by the Board, effective immediately after the time of the annual meeting the authorized number of directors will be reduced to eight.

The fiscal year for the Board begins March 1 of each year. The membership during the 2009 Agilent fiscal year and the function of each committee is described below. During the 2009 Agilent fiscal year, the Board held eight meetings. The Audit and Finance, Nominating/Corporate Governance, Compensation andCommittee; EC: Executive Committees held thirteen, two, five and one meeting(s), respectively. Each director attended at least 75% of the aggregate number of Board and applicable committee meetings held when the director was serving on the Board.

| | | | | | | | | | | | | |

Name of Director

| | Audit and Finance

| | Compensation

| | Nominating

| | Executive

| |

|---|

| |

Non-Employee Directors:

| | | | | | | | | | | | | |

Paul N. Clark(1)

| | | | | | X | | | X | | | | |

James G. Cullen(2)

| | | | | | | | | X | * | | X | * |

Robert J. Herbold(3)

| | | X | | | | | | X | | | | |

Robert L. Joss(4)

| | | X | | | | | | X | | | | |

Koh Boon Hwee(5)

| | | | | | X | | | X | | | | |

Heidi Fields(6)

| | | X | * | | | | | X | | | | |

David M. Lawrence, M.D.(7)

| | | | | | X | * | | X | | | | |

A. Barry Rand(8)

| | | | | | X | | | X | | | | |

Employee Directors:

| | | | | | | | | | | | | |

William P. Sullivan(9)

| | | | | | | | | | | | X | |

X = Committee member; * = Chairperson

(1)Mr. Clark has served as a director since May 2006.

(2)Mr. Cullen has served as a director since April 2000 and as the Non-Executive Chairman of the Board since March 1, 2005.

(3)Mr. Herbold has served as a director since June 2000.

(4)Mr. Joss has served as a director since July 2003.

(5)Mr. Koh has served as a director since May 2003.

(6)Ms. Fields has served as a director since February 2000.

(7)Dr. Lawrence has served as a director since July 1999.

(8)Mr. Rand has served as a director since November 2000.

(9)Mr. Sullivan has served as a director since March 1, 2005.

Agilent encourages, but does not require, its Board members to attend the annual stockholders meeting. Last year, two of our directors attended the annual stockholders meeting.Committee; C: Chairperson; M: Member

| SUMMARY INFORMATION |

TableIndependent Registered Public Accounting Firm

We ask that our stockholders ratify the selection of Contents

Audit and Finance Committee

The Audit and Finance Committee is responsible for the oversight of the quality and integrity of Agilent's consolidated financial statements, its compliance with legal and regulatory requirements, the qualifications and independence of itsPricewaterhouseCoopers LLP as Agilent’s independent registered public accounting firm for fiscal year 2013. Below is summary information about PricewaterhouseCoopers’ fees for services during fiscal years 2012 and 2011:

| | | | | | | % of | | | | | % of | |

| Fee Category: | | Fiscal 2012 | | Total | | Fiscal 2011 | | Total | |

| Audit Fees | | $ | 6,296,000 | | 94.1 | | $ | 7,486,000 | | 90.1 | |

| Audit-Related Fees | | | 105,000 | | 1.6 | | | 97,000 | | 1.2 | |

| Tax Fees: | | | | | | | | | | | |

| Tax compliance/preparation | | | 285,000 | | 4.3 | | | 720,000 | | 8.7 | |

| | Other tax services | | | 0 | | 0.0 | | | 0 | | 0.0 | |

| Total Tax Fees | | | 285,000 | | 4.3 | | | 720,000 | | 8.7 | |

| All Other Fees | | | 4,000 | | 0.0 | | | 3,000 | | 0.0 | |

| Total Fees | | $ | 6,690,000 | | 100 | | $ | 8,306,000 | | 100 | |

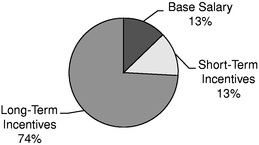

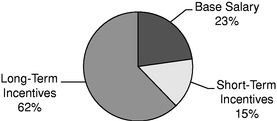

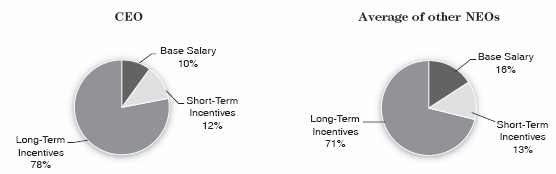

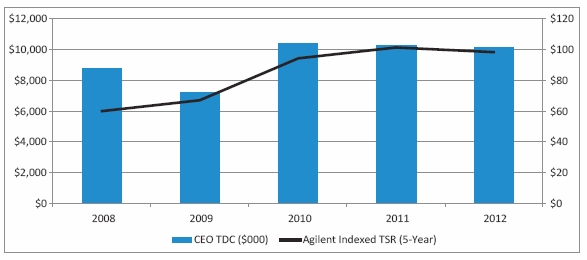

Executive Compensation Matters

The proxy statement contains information about Agilent’s executive compensation programs. In particular, you will find detailed information in the performance of its internal audit function and independent registered public accounting firm and other significant financial matters. In discharging its duties, the Audit and Finance Committee is expected to:

•have the sole authority to appoint, retain, compensate, oversee, evaluate and replace the independent registered public accounting firm;

•review and approve the scope of the annual internal and external audit;

•review and pre-approve the engagement of Agilent's independent registered public accounting firm to perform audit and non-audit services and the related fees;

•meet independently with Agilent's internal auditing staff, independent registered public accounting firm and senior management;

•review the adequacy and effectiveness of the system of internal control over financial reporting and any significant changes in internal control over financial reporting;

•review Agilent's consolidated financial statements and disclosures including "Management'sCompensation Discussion and Analysis of Financial Conditionstarting on page 29 and Results of Operations"the Executive Compensation tables starting on page 44.Our executive officers are compensated in the Company's reports on Form 10-K or Form 10-Q;

•establisha manner consistent with Agilent’s business strategy, competitive practice, sound compensation governance principles, and oversee procedures for (a) the receipt, retentionstockholder interests and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and (b) the confidential anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters;

•review funding and investment policies, implementation of fundingconcerns. Our compensation policies and investment performance of Agilent's benefit plans;

•monitor compliance with Agilent's Standards of Business Conduct;decisions are focused on pay-for-performance. As you can read, our executive compensation programs have remained substantially the same for several years, and

•review disclosures from Agilent's independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independence of accountant's communications we believe that our programs are well aligned with the audit committeeinterests of the concerning independence.

Compensation Committeeour shareholders and are instrumental to achieving our business strategy.

The Compensation Committee reviews the performance of Agilent's elected officers and other key employees and determines, approves and reports to the Board on the elements of their compensation, including total cash compensation and long-term equity based incentives. In addition, the Compensation Committee:

•approves and monitors Agilent's benefit plan offerings;

•supervises and oversees the administration of Agilent's incentive compensation, variable pay and stock programs;

•recommends to the Board the annual retainer fee as well as otherdetermining executive compensation for non-employee directors;

•establishes comparator peer group and compensation targets based on this peer group for the Company's named executive officers; and

Table of Contents

•has sole authority to retain and terminate executive compensation consultants.

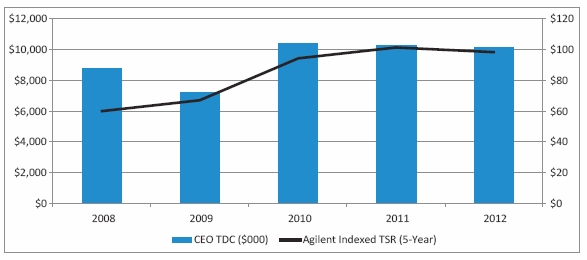

For more information on the responsibilities and activities offiscal year 2012, the Compensation Committee includingof the committee's processes forBoard considered the overwhelming stockholder support that the “Say-on-Pay” proposal received at our March 21, 2012 annual meeting of stockholders. As a result, the Compensation Committee continued to apply the same effective principles and philosophy it has used in previous years in determining executive compensation see "Compensation Discussion and Analysis," "Compensation Committee Report," "Executive Compensation"will continue to consider stockholder concerns and feedback in the Compensation Committee's charter.future. Fiscal year 2012 was successful for Agilent despite uncertainties in the economy. Revenue, orders, net income and earnings per share improved year over year. However, performance did not meet our targets. Therefore, consistent with our philosophy to pay for performance, our CEO’s total direct compensation dropped slightly from the preceding fiscal year.

The Compensation Committee also helps determineWe are requesting your non-binding vote to approve the compensation for non-employee directors. The process the Compensation Committee undertakes for setting non-employee director compensation is similar to that of setting executive officer compensation. The Compensation Committee is aided by an independent consultant, currently F. W. Cook & Co., Inc., who is selected and retained by the Compensation Committee. The role of the independent consultant isCompany’s named executive officers as described on pages 29 to measure56, including the Summary Compensation Table and benchmark our non-employee director compensation against a certain peer groupsubsequent tables on pages 44 to 56 of companies with respect to appropriate compensation levels for positions comparable in the market. The independent consultant recommends appropriate retainers, committee chair retainers, grant valuesproxy statement.

| TABLE OF CONTENTS |

2013 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

| | Page |

| PROPOSAL 1 – ELECTION OF DIRECTORS | | 6 |

| Director Nominees for Election to New Three-Year Terms That Will Expire in 2016 | | 7 |

| Continuing Directors Not Being Considered for Election at this Annual Meeting | | 8 |

| Directors Whose Terms Will Expire in 2014 | | 8 |

| Directors Whose Terms Will Expire in 2015 | | 10 |

| CORPORATE GOVERNANCE MATTERS | | 12 |

| Board Leadership Structure | | 12 |

| Board’s Role in Risk Oversight | | 12 |

| Majority Voting for Directors | | 13 |

| Board Communications | | 13 |

| Director Independence | | 13 |

| COMMITTEES OF THE BOARD OF DIRECTORS | | 15 |

| Audit and Finance Committee | | 15 |

| Compensation Committee | | 16 |

| Nominating/Corporate Governance Committee | | 16 |

| Executive Committee | | 17 |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | | 18 |

| RELATED PERSON TRANSACTIONS POLICY AND PROCEDURES | | 18 |

| PROPOSAL 2 – RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC | | |

| ACCOUNTING FIRM | | 20 |

| Fees Paid to PricewaterhouseCoopers LLP | | 20 |

| Policy on Audit and Finance Committee Preapproval of Audit and Permissible Non-Audit Services | | |

| of Independent Registered Public Accounting Firm | | 21 |

| AUDIT AND FINANCE COMMITTEE REPORT | | 22 |

| COMMON STOCK OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 23 |

| Beneficial Ownership Tables | | 23 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 24 |

| COMPENSATION OF NON-EMPLOYEE DIRECTORS | | 25 |

| Summary of Non-Employee Director Annual Compensation for the 2012 Plan Year | | 25 |

| Non-Employee Director Compensation for Fiscal Year 2012 | | 26 |

| Non-Employee Director Reimbursement Practice for Fiscal Year 2012 | | 27 |

| Non-Employee Director Stock Ownership Guidelines | | 27 |

| PROPOSAL 3 – NON-BINDING ADVISORY VOTE TO APPROVE THE COMPENSATION OF | | |

| AGILENT’S NAMED EXECUTIVE OFFICERS | | 28 |

| COMPENSATION DISCUSSION AND ANALYSIS | | 29 |

| Introduction | | 29 |

| Executive Summary | | 29 |

| Compensation Philosophy | | 30 |

| Compensation Governance | | 31 |

| Recoupment Policy | | 31 |

| Hedging and Insider Trading Policy | | 31 |

| Peer Group | | 32 |

| Process and Role of Management | | 33 |

| CEO Compensation | | 34 |

| Fiscal Year 2012 Compensation | | 34 |

| CEO Pay-for-Performance Alignment | | 35 |

| Base Salary | | 36 |

| Short-Term Cash Incentives | | 36 |

| Long-Term Incentives | | 38 |

| TABLE OF CONTENTS |

2013 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

| | Page |

| Equity Grant Practices | | 41 |

| Benefits | | 41 |

| Deferred Compensation | | 42 |

| Pension Plans | | 42 |

| Policy Regarding Compensation in Excess of $1 Million a Year | | 42 |

| Stock Ownership Guidelines | | 43 |

| Termination and Change of Control | | 43 |

| EXECUTIVE COMPENSATION | | 44 |

| Summary Compensation Table | | 44 |

| Grants of Plan-Based Awards in Last Fiscal Year | | 46 |

| Outstanding Equity Awards at Fiscal Year-End | | 47 |

| Option Exercises and Stock Vested at Fiscal Year-End | | 49 |

| Pension Benefits | | 49 |

| Retirement Plan | | 50 |

| Deferred Profit-Sharing Plan | | 50 |

| Supplemental Benefit Retirement Plan | | 51 |

| Non-Qualified Deferred Compensation in Last Fiscal Year | | 51 |

| France Pension Plan | | 53 |

| International Relocation Benefit Plan | | 53 |

| Termination and Change of Control Arrangements | | 53 |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PATICIPATION | | 56 |

| COMPENSATION COMMITTEE REPORT | | 56 |

| PROPOSAL 4 – STOCKHOLDER PROPOSAL REGARDING BOARD DECLASSIFICATION | | 57 |

| GENERAL INFORMATION ABOUT THE MEETING | | 59 |

| Why did I receive a one-page notice in the mail regarding the Internet availability of proxy | | |

| materials instead of a full set of proxy materials? | | 59 |

| Why am I receiving these materials? | | 59 |

| What is included in these materials? | | 59 |

| What information is contained in these materials? | | 59 |

| What proposals will be voted on at the annual meeting? | | 59 |

| What is the Agilent Board’s voting recommendation? | | 59 |

| What shares owned by me can be voted? | | 60 |

| What is the difference between holding shares as a stockholder of record and as a | | |

| beneficial owner? | | 60 |

| How can I vote my shares in person at the annual meeting? | | 60 |

| How can I vote my shares without attending the annual meeting? | | 61 |

| Can I revoke my proxy or change my vote? | | 61 |

| How are votes counted? | | 61 |

| What is the voting requirement to approve each of the proposals? | | 62 |

| What does it mean if I receive more than one Notice, proxy or voting instruction card? | | 62 |

| Where can I find the voting results of the annual meeting? | | 62 |

| What happens if additional proposals are presented at the annual meeting? | | 63 |

| What is the quorum requirement for the annual meeting? | | 63 |

| Who will count the vote? | | 63 |

| Is my vote confidential? | | 63 |

| Who will bear the cost of soliciting votes for the annual meeting? | | 63 |

| May I propose actions for consideration at next year’s annual meeting of stockholders or nominate | | |

| individuals to serve as directors? | | 63 |

| How do I obtain a separate set of proxy materials if I share an address with other stockholders? | | 64 |

| If I share an address with other stockholders of Agilent, how can we get only one set of voting | | |

| materials for future meetings? | | 64 |

| ELECTION OF DIRECTORS |

PROPOSAL 1 – ELECTION OF DIRECTORS

Director Nomination Criteria: Qualifications and stock ownership guidelines to the Compensation Committee. This information is reviewed, discussed and finalized at a Compensation Committee meeting and a recommendation is made to the full Board. The full Board makes the final determination on non-employee director compensation.

Nominating/Corporate Governance CommitteeExperience

The Nominating/Corporate Governance Committee proposes a slate(the “Nominating Committee”) performs an assessment of the skills and the experience needed to properly oversee the interests of the Company. Generally the Nominating Committee reviews both the short and long term strategies of the Company to determine what current and future skills and experience are required of the Board in exercising its oversight function. The Nominating Committee then compares those skills to the skills of the current directors for election by Agilent's stockholders at each annual meeting and appoints candidatespotential director candidates. The Nominating Committee conducts targeted efforts to fill any vacancies on the Board. It is also responsible for reviewing management succession plans, determining the appropriate Board size and committee structure and developing and reviewing corporate governance principles applicable to Agilent.

The Nominating/Corporate Governance Committee will consider candidates recommended for nomination by stockholders, provided that the recommendations are made in accordance with the procedures described in the section entitled "Additional Questions and Information Regarding the Annual Meeting and Stockholder Proposals" located at the end of this Proxy Statement. Candidates recommended for nomination by stockholders that comply with these procedures will receive the same consideration as other candidates recommended by the Nominating/Corporate Governance Committee.

Agilent hires a third party search firm to help identify and facilitaterecruit individuals who have the screeningqualifications identified through this process. The Nominating Committee looks for its current and interview processpotential directors collectively to have a mix of candidatesskills and qualifications, some of which are described below:

- a reputation for

director. To be considered by the Nominating/Corporate Governance Committee, a director nominee must have:•- personal and professional integrity and ethics;

- executive or similar policy-making experience

as a Board memberin relevant business or senior officer of a Fortune 200 or equivalent company or have achieved nationaltechnology areas ornational prominence in an academic, government or other relevant field;

• - breadth of experience;

• - soundness of judgment;

• - the ability to make independent, analytical inquiries;

• - the willingness and ability to devote the time required to perform Board

activities adequately; andactivitiesadequately;

•- the ability to represent the total corporate interests of

Agilent.

Agilent; and

Tablethe ability to represent the long-term interests of Contentsstockholders as a whole. In addition to these minimum requirements, the Nominating/Corporate GovernanceNominating Committee will also evaluateconsider whether the candidate'scandidate’s skills are complementary to the existing Board members' skillsmembers’ skills; the diversity of the Board in factors such as age, experience in technology, manufacturing, finance and marketing, international experience and culture; and the Board'sBoard’s needs for specific operational, management financial, international, technological or other expertise. The search firm screensNominating Committee from time to time reviews the appropriate skills and characteristics required of board members, including factors that it seeks in board members such as diversity of business experience, viewpoints and, personal background, and diversity of skills in technology, finance, marketing, international business, financial reporting and other areas that are expected to contribute to an effective Board of Directors. In evaluating potential candidates does reference checks, prepares a biographyfor the Board of Directors, the Nominating Committee considers these factors in the light of the specific needs of the Board of Directors at that time.

Current Director Terms

Agilent’s Board is divided into three classes serving staggered three-year terms. Directors for each candidateclass are elected at the annual meeting of stockholders held in the year in which the term for their class expires. Agilent’s Bylaws, as amended, allow the Nominating/Corporate Governance CommitteeBoard to reviewfix the number of directors by resolution. Our Board currently consists of nine directors divided into three classes. One class of directors is elected annually, and helps set up interviews.each class serves for a term of three years. The Nominating/Corporate Governance Committeeterms of the three current director nominees will expire at this Annual Meeting. The composition of the Board and Agilent'sthe term expiration dates for each director is as follows:

| Class | Directors | Term Expires |

| I | Paul N. Clark, James G. Cullen and Tadataka Yamada, M.D. | 2013 |

| II | Heidi Fields, David M. Lawrence, M.D. and A. Barry Rand | 2014 |

| III | Robert J. Herbold, Koh Boon Hwee and William P. Sullivan | 2015 |

| ELECTION OF DIRECTORS(CONTINUED) |

Directors elected at the 2013 annual meeting will hold office for a three-year term expiring at the annual meeting in 2016 (or until their respective successors are elected and qualified, or until their earlier death, resignation or removal). All of the nominees are currently directors of Agilent. Information regarding each of the nominees is provided below as of December 31, 2012. There are no family relationships among Agilent’s executive officers and directors.

Director Nominees for Election to New Three-Year Terms That Will Expire in 2016

| PAUL N. CLARK | | |

| | |

Age:65 | Agilent Committees: | Public Directorships: |

Director Since:May 2006 | - Audit and Finance

- Nominating/Corporate Governance

| None |

| | Former Public Directorships Held During the Past Five Years: |

| | - Amylin Pharmaceuticals, Inc.

- Talecris Biotherapeutics Holdings Corp.

|

Mr. Clark has been an Operating Partner of Genstar Capital, LLC since August 2007, a middle market private equity firm that focuses on investments in selected segments of life sciences and healthcare services, industrial technology, business services and software. Prior to that, Mr. Clark was the Chief Executive Officer interview candidates that meet the criteria,and President of ICOS Corporation, a biotherapeutics company, from June 1999 to January 2007, and the Nominating/Corporate Governance Committee selects candidates that best suit the Board's needs. We do not use a third party to evaluate current Board members.

The Nominating/Corporate Governance Committee also administers Agilent's Related Person Transactions Policy and Procedures. See "Related Person Transactions Policy and Procedures" for more information.

Executive Committee

The Executive Committee meets or takes written action when the Board is not otherwise meeting. The Committee has full authority to act on behalfChairman of the Board except that it cannot amend Agilent's Bylaws, recommend any action that requiresof Directors of ICOS from February 2000 to January 2007. From 1984 to December 1998, Mr. Clark worked in various capacities for Abbott Laboratories, a health care products manufacturer, retiring from Abbott Laboratories as Executive Vice President and a board member. His previous experience included senior positions with Marion Laboratories, a pharmaceutical company, and Sandoz Pharmaceuticals (now Novartis Corporation), a pharmaceutical company.

Mr. Clark has significant experience in the approvalpharmaceutical and biotechnology industries, including his experience serving in senior management positions with ICOS Corporation (where he served as Chief Executive Officer and President), Abbott Laboratories, Marion Laboratories and Sandoz Pharmaceuticals. In addition, Mr. Clark brings considerable public company director experience and perspective on company management and governance issues and practices.

| JAMES G. CULLEN | | |

| | |

Age: 70 | Agilent Committees: | Public Directorships: |

Director Since: April 2000 | - Nominating/Corporate Governance (Chair)

- Executive (Chair)

| - Johnson & Johnson

- Prudential Financial, Inc.

- Neustar, Inc.

|

| | |

| | Former Public Directorships Held During the Past Five Years: |

| | None |

Mr. Cullen has been a director of Agilent since April 2000 and the stockholders, fill vacancies on the Board or any Board committee, fix director compensation, amend or repeal any non-amendable or non-repealable resolutionNon-Executive Chairman of the Board declaresince March 2005. Mr. Cullen was President and Chief Operating Officer of Bell Atlantic Corporation (now known as Verizon) from 1997 to June 2000 and a distributionmember of the office of chairman from 1993 to June 2000. Prior to this appointment, Mr. Cullen was the President and Chief Executive Officer of the Telecom Group of Bell Atlantic from 1995 to 1997. Prior to the stockholders exceptcreation of Bell Atlantic on January 1, 1984, Mr. Cullen held management positions with New Jersey Bell from 1966 to 1981 and AT&T from 1981 to 1983.

Mr. Cullen has considerable managerial and operational experience and expertise from his senior leadership position with Bell Atlantic and its predecessors. In addition, Mr. Cullen brings significant public company director experience and perspective on public company management and governance. Mr. Cullen has a strong understanding of Agilent having served on the board for over 10 years, including more than 5 years as the non-executive chairman.

| ELECTION OF DIRECTORS(CONTINUED) |

| TADATAKA YAMADA, M.D. | | |

| | |

Age:67 | Agilent Committees: | Public Directorships: |

Director Since:January 2011 | - Compensation

- Nominating/Corporate Governance

| - Takeda Pharmaceutical Co. Ltd.

|

| | Former Public Directorships Held During the Past Five Years: |

| | - GlaxoSmithKline plc

- Covidien plc

|

Dr. Yamada currently serves as the Chief Medical and Scientific Officer of Takeda Pharmaceuticals International, Inc., a research-based global pharmaceutical company. Dr. Yamada previously served as President of the Global Health Program of the Bill & Melinda Gates Foundation from June 2006 to June 2011. From 2000 to 2006, Dr. Yamada was Chairman of Research and Development for GlaxoSmithKline Inc. and prior to that, he held research and development positions at rates determined bySmithKline Beecham. Prior to joining SmithKline Beecham, Dr. Yamada was Chairman of the Department of Internal Medicine at the University of Michigan Medical School and Physician-in-Chief of the University of Michigan Medical Center.

Dr. Yamada brings to our Board a unique perspective with his experience as the former President of the Global Health Program of the Bill & Melinda Gates Foundation as well as his significant research and development experience. Dr. Yamada’s extensive pharmaceutical industry knowledge gives him an insight into a number of issues facing Agilent that other directors might not possess.

Agilent’s Board recommends a vote FOR the election to the Board appointof each of the

foregoing nominees.

Continuing Directors Not Being Considered for Election at this Annual Meeting

The Agilent directors whose terms are not expiring this year are listed below. They will continue to serve as directors for the remainder of their terms or such other committees or take any action not permitted under Delaware law to be delegated to a committee.date, in accordance with Agilent’s Bylaws. Information regarding each of such directors is provided below.

Statement on Directors Whose Terms Will Expire in 2014

| HEIDI FIELDS | | |

| | |

Age:58 | Agilent Committees: | Public Directorships: |

Director Since:February 2000 | - Audit and Finance (Chair)

- Nominating/Corporate Governance

| |

| | Former Public Directorships Held During the Past Five Years: |

| | None |

Ms. Fields served as Executive Vice President and Chief Financial Officer of Blue Shield of California from September 2003 through December 2012. She served as Executive Vice President and the Chief Financial Officer of Gap, Inc. from 1999 to January 2003. Prior to assuming that position, Ms. Fields served as the Chief Financial Officer of ITT Industries, Inc. from 1995 to 1999. From 1979 to 1995, she held senior financial management positions at General Motors Corporation, including Vice President and Treasurer.

Ms. Fields possesses significant experience and experience in management and financial matters, having served as the Chief Financial Officer of both public and private companies, including at Blue Shield of California, Gap, Inc. and ITT Industries, Inc. Ms. Fields is the chairperson of our Audit and Finance Committee and is qualified as a financial expert under SEC guidelines. In addition, Ms. Fields has considerable experience and expertise with Agilent having been a member of Agilent’s board of directors for over 10 years.

| ELECTION OF DIRECTORS(CONTINUED) |

| DAVID M. LAWRENCE, M.D. | | |

| | |

Age:72 | Agilent Committees: | Public Directorships: |

Director Since:July 1999 | - Compensation (Chair)

- Nominating/Corporate Governance

| |

| | Former Public Directorships Held During the Past Five Years: |

| | - Dynavax Technologies Corporation

|

Dr. Lawrence served as Chairman of the Board from 1992 to May 2002 and Chief Executive Officer from 1991 to May 2002 of Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals. From May 2002 to December 2002, he served as Chairman Emeritus of Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals. He held a number of management positions with these organizations prior to assuming these positions, including Vice Chairman of the Board and Chief Operating Officer.

Dr. Lawrence possesses considerable experience and expertise with Agilent having been a member of Agilent’s board of directors since its spin-off from Hewlett-Packard. In addition, Dr. Lawrence brings strong leadership experience in the healthcare industry, having served for a decade as Chairman and Chief Executive Officer of Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals. Dr. Lawrence brings notable public company director experience and perspective on public company management and governance issues and practices.

Pursuant to Agilent’s Corporate Governance Standards, the Board considered and approved Dr. Lawrence’s continued service beyond his 72nd birthday as a Board member until the end of his current term.

| A. BARRY RAND | | |

| | |

Age:68 | Agilent Committees: | Public Directorships: |

Director Since:November 2000 | - Compensation

- Nominating/Corporate Governance

| |

| | Former Public Directorships Held During the Past Five Years: |

| | None |

Mr. Rand has served as the Chief Executive Officer of AARP since April 2009. He served as Chairman and Chief Executive Officer of Equitant from February 2003 to April 2005 and as Non-Executive Chairman of Aspect Communications from February 2003 to October 2005. Mr. Rand was the Chairman and Chief Executive Officer of Avis Group Holdings, Inc. from November 1999 to April 2001. Prior to joining Avis Group, Mr. Rand was Executive Vice President, Worldwide Operations, for Xerox Corporation from 1992 to 1999. Mr. Rand is Chairman of the Board of Trustees of Howard University and holds a MBA from Stanford University where he also was a Stanford Sloan Executive Fellow. Mr. Rand also holds several honorary doctorate degrees.

Mr. Rand possesses a strong mix of organizational and operational management skills having served as the chairman and/or chief executive officer of numerous companies, including past roles with Equitant, Avis Group Holdings and Aspect Communications, and his current position with the AARP. He brings public company director experience and perspective from his membership on the Campbell Soup board of directors and has considerable expertise with Agilent having served as a director for over 10 years.

| ELECTION OF DIRECTORS(CONTINUED) |

Directors Whose Terms Will Expire in 2015

| ROBERT J. HERBOLD | | |

| | |

Age:70 | Agilent Committees: | Public Directorships: |

Director Since:June 2000 | - Audit and Finance

- Nominating/Corporate Governance

| - Neptune Orient Lines Limited

|

| | Former Public Directorships Held During the Past Five Years: |

| | - ICOS Corporation

- Weyerhauser Co.

- Cintas Corporation

- First Mutual Bancshares, Inc.

|

Mr. Herbold has served as the Managing Director of the consulting firm The Herbold Group, LLC since 2003. He served as Executive Vice President and Chief Operating Officer of Microsoft Corporation from 1994 to April 2001 and served as an Executive Vice President (part-time) of Microsoft Corporation until June 2003. Prior to joining Microsoft, Mr. Herbold was employed by The Procter & Gamble Company for twenty-six years, and served as a Senior Vice President at The Procter & Gamble Company from 1990 to 1994.

�� Mr. Herbold possesses significant leadership experience and business expertise from his executive leadership positions with Microsoft Corporation and The Procter & Gamble Company. Having been a member of the Agilent board for over 10 years, Mr. Herbold has a strong knowledge of Agilent’s business. In addition, Mr. Herbold brings considerable public and private company director experience and perspective on public company management and governance issues and practices.

| KOH BOON HWEE | | |

| | |

Age:62 | Agilent Committees: | Public Directorships: |

Director Since:May 2003 | - Compensation

- Nominating/Corporate Governance

| - AAC Technologies Holdings, Inc.

- Sunningdale Tech, Ltd.

- Yeo Hiap Seng Ltd.

- Yeo Hiap Seng (Malaysia) Bhd.

|

| | |

| | Former Public Directorships Held During the Past Five Years: |

| | - MediaRing Limited

- DBS Group Holdings Ltd.

- DBS Bank Ltd.

|

Mr. Koh is the managing partner of Credence Capital Fund II (Cayman) Ltd., a private equity fund. Mr. Koh has served as the non-Executive Chairman of Sunningdale Tech Ltd. since January 2009 and previously served as its Executive Chairman and Chief Executive Officer from July 2005 to January 2009. He has served as the non-Executive Chairman of Yeo Hiap Seng Ltd. since April 2010 and Rippledot Capital Advisers Pte. Ltd. since February 2011. He served as Executive Director of MediaRing Limited from February 2002 to August 2009; Chairman of DBS Bank from January 2006 to April 2010; Chairman of Singapore Airlines from July 2001 to December 2005 and Chairman of Singapore Telecom from April 1992 to August 2001. Mr. Koh spent fourteen years with Hewlett-Packard Company in its Asia Pacific region.

Mr. Koh possesses a strong mix of leadership and operational experience from his various senior positions with Sunningdale Tech, AAC Technologies, MediaRing Limited, DBS Bank, Singapore Airlines and Singapore Telecom. In addition, Mr. Koh has deep experience in the Asia Pacific region and brings that knowledge and perspective to the Board. Mr. Koh has extensive experience with Agilent and its predecessor, Hewlett-Packard, having served on the Agilent board for over 9 years and having spent 14 years with Hewlett-Packard.

| ELECTION OF DIRECTORS(CONTINUED) |

| WILLIAM P. SULLIVAN | | |

| | |

Age:63 | Agilent Committees: | Public Directorships: |

Director Since:March 2005 | | - URS Corporation

- Avnet, Inc.

|

| |

|

| | Former Public Directorships Held During the Past Five Years: |

| | None |

Mr. Sullivan has served as Agilent’s Chief Executive Officer since March 2005 and served as President from March 2005 to November 2012. Before being named as Agilent’s Chief Executive Officer, Mr. Sullivan served as Executive Vice President and Chief Operating Officer from March 2002 to March 2005. In that capacity, he shared the responsibilities of the president’s office with Agilent’s former President and Chief Executive Officer, Edward W. Barnholt. Mr. Sullivan also had overall responsibility for Agilent’s Electronic Products and Solutions Group, the company’s largest business group. Prior to assuming that position, Mr. Sullivan served as our Senior Vice President, Semiconductor Products Group, from August 1999 to March 2002. Before that, Mr. Sullivan held various management positions at Hewlett-Packard Company.

Mr. Sullivan has broad and deep experience with Agilent and its businesses having been an employee of Agilent and its predecessor, Hewlett-Packard, for over 30 years. During the course of his career, he has developed considerable expertise in, and in-depth knowledge of, Agilent’s businesses, having seen them as an individual contributor and at numerous levels of management. This perspective gives valuable insight to the Agilent board. Mr. Sullivan also brings public company director experience and perspective from his current positions on the URS Corporation and Avnet boards.

| CORPORATE GOVERNANCE |

Corporate Governance Matters

Agilent has had formal corporate governance standards in place since the Company'sCompany’s inception in 1999. We have reviewed internally and with the Board the provisions of the Sarbanes-Oxley Act of 2002 ("(“Sarbanes-Oxley Act"Act”), the rules of the SEC and the NYSE'sNYSE’s corporate governance listing standards regarding corporate governance policies and processes and are in compliance with the rules and listing standards.

We have adopted charters for our Compensation Committee, Audit and Finance Committee, and Nominating/Corporate Governance Committee and Executive Committee consistent with the applicable rules and standards. You can access our committee charters, Amended and Restated Corporate Governance Standards and Standards of Business Conduct by clicking on "Governance Policies"“Governance Policies” in the "Corporate Governance"“Corporate Governance” section, which is on the left side of our web page at www.investor.agilent.com.

Board Leadership Structure

Agilent currently separates the positions of chief executive officer and chairman of the Board. Since March 2005, Mr. Cullen, one of our independent directors, has served as our chairman of the Board. The responsibilities of the chairman of the Board include: setting

the agenda for each Board meeting, in consultation with the chief executive officer; chairing the meetings of independent directors; and facilitating and conducting, with the Nominating/Corporate Governance Committee, the annual self-assessments by the Board and each standing committee of the Board, including periodic performance reviews of individual directors.

Separating the positions of chief executive officer and chairman of the Board allows our chief executive officer to focus on our day-to-day business, while allowing the chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. The Board believes that having an independent director serve as chairman of the Board is the appropriate leadership structure for Agilent at this time.

However, our Corporate Governance Standards permit the roles of the chairperson of the Board and the chief executive officer to be filled by the same or different individuals. This provides the board with flexibility to determine whether the two roles should be combined in the future based on Agilent’s needs and the Board’s assessment of Agilent’s leadership from time to time. Our Corporate Governance Standards provide that, in the event that the chairperson of the Board is also the chief executive officer, the Board may consider the election of an independent Board member as a lead independent director.

Board’s Role in Risk Oversight

The Board executes its risk management responsibility directly and through its committees. The Audit and Finance Committee has primary responsibility for overseeing Agilent’s enterprise risk management process. The Audit and Finance Committee receives updates and discusses individual and overall risk areas during its meetings, including the Company’s financial risk assessments, risk management policies and major financial risk exposures and the steps management has taken to monitor and control such exposures. The Compensation Committee oversees risks associated with our compensation policies and practices with respect to both executive compensation and compensation generally.

| CORPORATE GOVERNANCE |

The Compensation Committee receives reports and discusses whether Agilent’s compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company.

The full Board is kept abreast of its committees’ risk oversight and other activities via reports of the committee chairpersons to the full Board during Board meetings.

Majority Voting for Directors

Our Bylaws provide for majority voting of directors regarding director elections. In an uncontested election, any nominee for director shall be elected by the vote of a majority of the votes cast with respect to the director. A "majority“majority of the votes cast" shall meancast” means that the number of shares voted "FOR"“FOR” a director must exceed 50% of the votes cast with respect to that director. The "votes cast"“votes cast” shall include votes to withhold authority and exclude votes to "ABSTAIN"“ABSTAIN” with respect to that director'sdirector’s election. If a director is not elected due to a failure to receive a majority of the votes cast and his or her successor is not otherwise elected and qualified, the director shall promptly tender his or her resignation following certification of the stockholder vote. The Nominating/Corporate Governance Committee will consider the resignation offer and recommend to the Board whether to accept or reject it, or whether other action should be taken. The Board will act on the Nominating/Corporate Governance Committee'sCommittee’s recommendation within 90 days

Table of Contents

following certification of the stockholder vote. Thereafter, the Board will promptly disclose their decision and the rationale behind it in a press release to be disseminated in the same manner thatas Company press releases typically are distributed. Any director who tenders his or her resignation pursuant to this provision shall not participate in the Nominating/Corporate Governance Committee recommendation or Board action regarding whether to accept the resignation offer.

Board Communications

Stockholders and other interested parties may communicate with the Board and Agilent'sAgilent’s Non-Executive ChairmanChairperson of the Board of Directors by filling out the form at "Contact Chairman"“Contact

Chairman” under "Corporate Governance"“Corporate Governance” at www.investor.agilent.com or by writing to James G. Cullen, c/o Agilent Technologies, Inc., General Counsel, 5301 Stevens Creek Blvd., MS 1A-11, Santa Clara, California 95051. The General Counsel will perform a legal review in the normal discharge of her duties to ensure that communications forwarded to the Non-Executive ChairmanChairperson preserve the integrity of the process. For example, items that are unrelated to the duties and responsibilities of the Board such as spam, junk mail and mass mailings, product complaints, personal employee complaints, product inquiries, new product suggestions, resumes and other forms of job inquiries, surveys, business solicitations or advertisements (the "Unrelated Items"“Unrelated Items”) will not be forwarded to the Non-Executive Chairman.Chairperson. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will not be forwarded to the Non-Executive Chairman.Chairperson. Any communication that is relevant to the conduct of Agilent'sAgilent’s business and is not forwarded will be retained for one year (other than Unrelated Items) and made available to the Non-Executive ChairmanChairperson and any other independent director on request. The independent directors grant the General Counsel discretion to decide what correspondence shall be shared with Agilent management and specifically instruct that any personal employee complaints be forwarded to Agilent'sAgilent’s Human Resources Department.

Director Independence

Agilent adopted the following standards for director independence in compliance with the NYSE corporate governance listing standards:

1. No director qualifies as "independent"“independent” unless the Board affirmatively determines that the director has no material relationship with Agilent or any of its subsidiaries (either directly, or as a partner, shareholderstockholder or officer of an organization that has a relationship with Agilent). Agilent or any of its subsidiaries must identify which directors are independent and disclose the basis for that determination.

In addition, a director is not independent if:

2. The director is, or has been within the last three years, an employee of Agilent or any of its subsidiaries, or an immediate family member

| CORPORATE GOVERNANCE |

is, or has been within the last three years, an executive officer of Agilent or any of its subsidiaries.

3. The director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from Agilent or any of its subsidiaries, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

4. (A) The director is a current partner or employee of a firm that is Agilent'sAgilent’s internal or external auditor; (B) the director has an immediate family member who is a current partner of

Table of Contents

such a firm; (C) the director has an immediate family member who is a current employee of such a firm and personally works on Agilent'sAgilent’s audit; or (D) the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on Agilent'sAgilent’s or any of its subsidiaries'subsidiaries’ audit within that time.

5. The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of Agilent'sAgilent’s or any of its subsidiaries'subsidiaries’ current executive officers at the same time serves or served on that company'scompany’s compensation committee.

6. The director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, Agilent or any of its subsidiaries for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company'scompany’s consolidated gross revenues.

The Board determined that Paul N. Clark, James G. Cullen, Heidi Fields, Robert J. Herbold, Robert L. Joss, Koh Boon Hwee, Heidi Fields, David M. Lawrence, M.D. and, A. Barry Rand meetand Tadataka Yamada, M.D. met the aforementioned independence standards. William P. Sullivan doesdid not meet the aforementioned independence standards because he is Agilent'sAgilent’s current President and Chief Executive Officer and an employee of Agilent.

Agilent's Agilent’s non-employee directors meet at regularly scheduled executive sessions without management. As the Non-Executive Chairman of the Board, James G. Cullen was chosen to preside at the regularly scheduled executive sessions of the non-management directors.

| CORPORATE GOVERNANCE |

Table of ContentsCOMMITTEES OF THE BOARD OF DIRECTORS

| | | | Nominating/ | |

| | Audit and | | Corporate | |

| Director | Board | Finance | Compensation | Governance | Executive |

| Paul N. Clark | ü | ü | | ü | |

| James G. Cullen | CHAIR | | | CHAIR | CHAIR |

| Heidi Fields | ü | CHAIR | | ü | |

| Robert J. Herbold | ü | ü | | ü | |

| Koh Boon Hwee | ü | | ü | ü | |

| David M. Lawrence, M.D. | ü | | CHAIR | ü | |

| A. Barry Rand | ü | | ü | ü | |

| Tadataka Yamada, M.D. | ü | | ü | ü | |

| William P. Sullivan | ü | | | | ü |

| No. of Meetings in FY2012 | 7 | 12 | 4 | 4 | 0 |

DIRECTOR COMPENSATION AND STOCK OWNERSHIP GUIDELINES

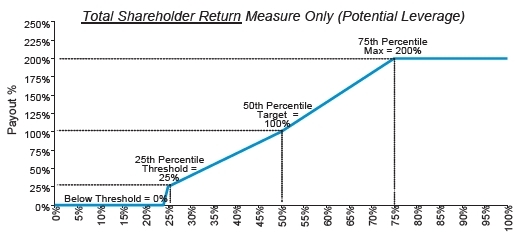

Directors who are employed by Agilent do not receive any compensation for their Board activities. As a result, Mr. Sullivan, an employee of Agilent, received no additional compensation for his Board services. The general policy of the Board is that compensation for non-employee directors should be a mix of cash and equity-based compensation. The non-employee director's compensation plan year begins on March 1 of each year. Except for the Non-Executive Chairman, non-employee directors in 2009 received (a) $75,000 in cash which is paid quarterly; (b) $75,000 in value of a stock option; and (c) $75,000 in value of deferred shares of Agilent common stock. Any newly appointed director receives $130,000 in value of deferred shares of Agilent common stock, pursuant to the 2009 Stock Plan. The stock options and the deferred shares vest quarterly over one year.